International Money Transfers to Foreign Countries: What You Need to Know

It's finally time to read the information on a much-needed international money transfer to foreign countries. Before you pay, there are a few things you need to know about international money transfers.

The most common reasons for making international money transfers include:

- One-off payments, you may transfer money to pay school and university costs in their local currency.

- Regular payments, pension transfers, overseas mortgage payments, wage transfers, and other types of income are all possible.

- Large transfers for unique purchases in foreign countries such as property acquisition or sale, starting a new business in a new region, or upgrading an existing one.

There are two points you need to keep as a note, which we will discuss in detail.

- Make sure you're familiar with the exchange rate before you make a transfer. This will help you budget and understand the cost of goods and other living expenses.

- There may be fees associated with making an international money transfer. Make sure you're aware of these so you can plan accordingly.

Beware of the Bank Hidden Charges

The majority of individuals, regardless of whether they live in the United States, Canada, or elsewhere, select their bank as a result of the belief that this is the safest and most dependable option available.

The fact is that, regardless of the sort of account you have, how frequently you make transfers, or how long you've been a loyal customer, most banks charge customers double exchange rates and hidden fees.

To put it another way, they're ripping money off each transaction in as many ways as possible because they know that few customers would bother to examine what and how much they're getting.

Whatever your bank is, the most effective purchase for your money has two factors:

- Transfer fees and foreign bank receiving costs: are the most common expenses to bear in mind.

- Exchange rates - many banks advertise that they are 'commission-free' while covertly overcharging the exchange rate. It's also tough to locate the precise rate and compare it because some companies just don't provide it.

The most effective method to save money is to compare and contrast various products, services and offers before making a purchasing decision. "How much will I get for my money after all costs are taken into account?" is a really basic question that can be answered in one of three ways.

- Exchange Rates

- Fees

- Transfer hidden/extra charges

How the Exchange Rates are Calculated?

Well, to be honest, there are many factors that influence the rate you are but to mention a few:

- Your transfer amount, the money you are sending usually the more it is the better the rates are.

- The timeframe you're aiming for (whether you want to lock in an exchange rate for up to 12 months)

- What currencies are you investing in and selling, and how volatile are they?

- At the time of purchase, the exchange rate level.

Is There a Solution for International Money transfers Alternate to Banks?

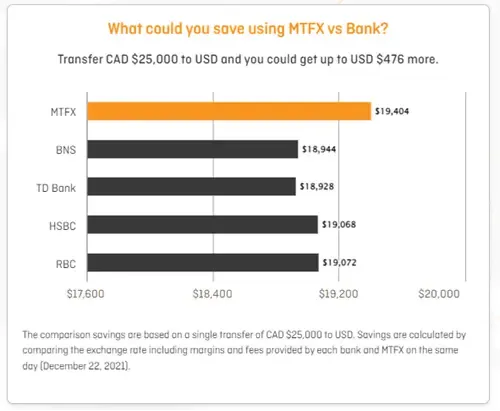

It's worth comparing your high street bank's exchange rates with those supplied by several currency specialists, like MTFX foreign exchange to see whether they're competitive.

How Much will I Save if I Use a Currency Specialist/Foreign Exchange Alternate to my Bank?

The average difference between using a currency specialist and your bank is about two to four percent. So, for example, on USD$100,000, this may represent a savings of $2,000 in just the exchange rate.

It's also worth noting that because running hundreds of branches is a huge logistical burden, the big banks must set their exchange rates once or twice a day. To ensure they remain successful, they must raise spreads to accommodate intraday rate volatility. Brokers provide real-time rates to clients, which might help you save money.

How Long will the Transfer Takes?

If you use a currency specialist like MTFX, you'll save on international banking fees, which can vary from bank to bank but are generally around $30 or $40. Plus, your money will arrive there much more quickly.

Transfers will usually be completed within one to two working days, depending on where you're sending the funds.

Why Transfer Time is Important for International Money Transfers?

The sooner you can move, the more money you'll make. The sooner your transaction is completed, the less risk there is that the exchange rate might worsen and your money will become worthless. Remember, as soon as you decide to relocate overseas or trade a property like a home, you are exposed to currency market volatility.

Just to help you with the Above Queries, you may find it Interesting that MTFX can be your Right International Payment Partner.

- Working since 1996 - over 25 years of experience.

- FINTRAC-Regulated. Fully Secured.

- Direct access to all the major currencies and regulations.

Open an account today to make easy international payments and get more with MTFX’s foreign exchange and money transfer services.

Popular Related Articles;

- Benefits of Paying your Overseas Suppliers in their Local Currency

- 4 steps for an effective hedging strategy

- A Quick Guide to Moving Abroad

- The Hidden Costs of Your Cross-border Payments

- 5 Steps in the Overseas Payment Process

- Have you Created a Post Covid Business Plan - MTFX Blog

- The Vaccine is here. Now What? Are fintech’s ‘The New Normal’?

Related Blogs

Stay ahead with fresh perspectives, expert tips, and inspiring stories.

Keep updated

Make informed decisions

Access tools to help you track, manage, and simplify your global payments.

Currency market updates

Track key currency movements and plan your transfers with confidence.

Create an account today

Start today, and let us take the hassle out of overseas transfers.