US Dollar Forecast & Global FX Outlook - March 2026

Stay ahead of currency markets with MTFX’s US Dollar latest Monthly Forecast for 2026. This page delivers expert analysis on USD performance, including exchange rate trends, economic drivers, and directional outlooks for major currency pairs like USD/CAD, EUR/USD, and GBP/USD. Access dynamic tables, FX projections, and economic event calendars to guide your international transfers and global payment planning. Whether you're a business or individual, use MTFX tools to make smarter foreign exchange decisions.

US Dollar Forecast & FX Monthly Outlook — March 2026

US Dollar Opens March Supported by Geopolitical Risk and Yield Differentials

The US dollar begins March trading from a position of relative strength, supported by elevated geopolitical tensions in the Middle East, firm US yields, and resilient domestic economic data.

Escalation involving Iran has driven a sharp increase in crude oil prices, injecting volatility into global markets. In risk-off environments, the USD continues to attract safe-haven flows. However, rising oil prices also raise inflation risks, potentially complicating Federal Reserve policy expectations.

Markets are currently balancing:

- Sticky US inflation

- Slower but positive US growth

- Elevated geopolitical premium in energy

- Diverging global central bank policies

This backdrop keeps the USD firm but volatile across major crosses.

March 2026 Global FX Performance

| Currency Pair | Mar 01, 2026 | Weekly Change | Monthly Change | Yearly Change |

|---|---|---|---|---|

| USD / CAD | 1.37 | -0.31% | 0.09% | -5.69% |

| EUR / USD | 1.18 | -0.62% | -0.90% | 11.70% |

| GBP / USD | 1.34 | -0.62% | -2.12% | 5.58% |

| USD / JPY | 156.01 | 1.67% | 0.95% | 5.17% |

| USD / CHF | 0.77 | 0.32% | 0.27% | -13.32% |

| USD / CNY | 6.86 | -0.38% | -0.80% | -5.52% |

| USD / INR | 91.08 | 0.75% | 1.41% | 5.08% |

| AUD / USD | 0.70 | 0.21% | 0.68% | 13.61% |

| NZD / USD | 0.60 | -0.17% | -1.64% | 5.91% |

| USD / MXN | 17.35 | 0.28% | 0.48% | -16.29% |

What’s Driving FX Markets in March 2026

Federal Reserve and Data-Driven Volatility

In March, markets are shifting from broad policy speculation to data confirmation. With inflation, employment, and consumer spending reports under the spotlight, expectations around the timing of Fed rate cuts remain fluid. The US dollar is trading in tight ranges, but volatility spikes quickly following key releases, reinforcing a reactive, headline-driven FX environment.

Central Bank Divergence Intensifies

Policy signals from Europe, the UK, and parts of Asia are beginning to diverge more clearly from the Federal Reserve’s path. While some central banks are leaning toward gradual easing, others remain cautious due to persistent inflation pressures. This widening policy gap is creating more defined trends across major currency pairs rather than the broad consolidation seen earlier in the year.

Commodities and Geopolitical Risk Premium

Energy markets and geopolitical developments are playing a larger role in March currency movements. Elevated oil prices are providing intermittent support to commodity-linked currencies, while safe-haven flows periodically lift the US dollar during periods of risk aversion. As a result, FX performance is increasingly tied to shifts in global risk sentiment and commodity price volatility.

| Currency Pair | Mar 2026 | Jun 2026 | Sep 2026 | Dec 2026 |

|---|---|---|---|---|

| USD / CAD | 1.37 | 1.36 | 1.35 | 1.35 |

| EUR / USD | 1.20 | 1.20 | 1.20 | 1.20 |

| GBP / USD | 1.36 | 1.36 | 1.36 | 1.35 |

| USD / JPY | 155.00 | 152.00 | 150.00 | 148.00 |

| USD / CHF | 0.78 | 0.79 | 0.79 | 0.79 |

| USD / CNY | 6.90 | 6.90 | 6.80 | 6.80 |

| USD / INR | 92.00 | 90.00 | 90.50 | 90.00 |

| AUD / USD | 0.70 | 0.71 | 0.72 | 0.73 |

| NZD / USD | 0.57 | 0.58 | 0.59 | 0.59 |

| USD / MXN | 18.40 | 18.70 | 18.50 | 18.20 |

March 2026 FX Highlights & Monthly Ranges

Range-driven trading conditions persist across major pairs, with risk sentiment, crude prices, and relative yield differentials shaping near-term direction. Businesses continue to face a tactical hedging environment, where clearly defined support and resistance levels offer opportunities to manage FX exposure proactively.

| Currency | Market News | |

|---|---|---|

CAD | Canadian Dollar (USD/CAD) USD/CAD enters March trading near 1.37 as markets balance geopolitical risk, oil price volatility, and diverging monetary expectations between the Federal Reserve and the Bank of Canada. Elevated crude prices linked to tensions involving Iran are providing underlying support for the Canadian dollar. However, safe-haven demand for the USD during risk-off episodes continues to limit sustained CAD appreciation. A sustained break below 1.35 would require stable risk sentiment and continued oil strength, while a move toward 1.39 would likely be driven by escalating geopolitical tensions or stronger US data. Bias: Neutral to mildly USD supportive in risk-off conditions. Mar 2026 USD/CAD Monthly Range: 1.3500 – 1.3900 | |

EUR | Euro (EUR/USD) EUR/USD is projected to trade in a broad consolidation pattern this month. The euro remains sensitive to energy prices and slowing regional growth, particularly as higher oil costs weigh more heavily on Europe than on the US. While ECB policy remains cautious, yield differentials continue to favor the USD in periods of volatility. Upside toward 1.22 would require improving Eurozone data and reduced geopolitical risk, while downside toward 1.17 may materialize if inflation concerns delay Fed easing further. Bias: Range-bound with downside risk on risk aversion. Mar 2026 EUR/USD Monthly Range: 1.1700 – 1.2200 | |

GBP | British Pound (GBP/USD) Sterling continues to navigate slower UK growth conditions and fiscal sensitivity. While GBP remains relatively stable, it lacks strong catalysts for sustained upside. If global risk sentiment stabilizes, GBP/USD may retest 1.38. However, broader USD demand during volatility spikes could push the pair toward 1.33. Bias: Neutral with modest downside risk in volatile markets. Mar 2026 GBP/USD Monthly Range: 1.3300 – 1.3800 | |

JPY | Japanese Yen (USD/JPY) USD/JPY remains elevated as Japan’s monetary policy continues to lag global tightening cycles. Yield differentials still support the dollar, keeping the pair near multi-year highs. However, sharp risk-off events may trigger intermittent yen strength. A sustained break above 158 would require stronger US yields, while a pullback toward 150 could emerge if geopolitical risk drives safe-haven flows into JPY. Bias: Elevated but vulnerable to risk-off corrections. Mar 2026 USD/JPY Monthly Range: 150.00 – 158.00 | |

CHF | Swiss Franc (USD/CHF) The Swiss franc remains a defensive currency alongside the US dollar. As geopolitical uncertainty persists, both currencies benefit from safe-haven demand, keeping this pair relatively compressed. USD/CHF is expected to trade within a narrow band, with volatility driven primarily by shifts in global risk sentiment rather than domestic fundamentals. Bias: Stable, low-volatility range. Mar 2026 USD/CHF Monthly Range: 0.7600 – 0.8000 | |

CNY | Chinese Yuan (USD/CNY) USD/CNY remains managed within policy comfort zones. China continues to balance growth stabilization with currency management, limiting excessive volatility. Trade flows, global demand trends, and domestic stimulus policies remain the main variables. Elevated oil prices add external pressure, but authorities are likely to maintain gradual adjustments rather than sharp swings. Bias: Managed stability with mild USD firmness. Mar 2026 USD/CNY Monthly Range: 6.80 – 7.00 | |

INR | Indian Rupee (USD/INR) The Indian rupee remains sensitive to energy import costs. Rising crude prices linked to Middle East tensions have increased short-term pressure on INR. If oil remains elevated, USD/INR may test the upper end of the projected range. Any pullback in energy prices or improvement in capital inflows could support a move back toward 90. Bias: Upside risk while oil remains elevated. Mar 2026 USD/INR Monthly Range: 90.00 – 93.50 | |

AUD | Australian Dollar (AUD/USD) The Australian dollar remains closely tied to global growth expectations and risk appetite. Heightened geopolitical tension has weighed on risk-linked currencies. However, stabilization in commodity demand and China-related recovery prospects could support gradual upside toward 0.72 later in the quarter. Bias: Soft in early March, recovery possible if risk stabilizes. Mar 2026 AUD/USD Monthly Range: 0.6800 – 0.7200 | |

NZD | New Zealand Dollar (NZD/USD) The New Zealand dollar remains one of the more risk-sensitive G10 currencies. Elevated geopolitical risk and slower global growth expectations keep NZD under pressure. A move toward 0.60 would require improved risk appetite, while downside toward 0.55 could materialize if volatility spikes further. Bias: Cautious, risk-sensitive profile. Mar 2026 NZD/USD Monthly Range: 0.5500 – 0.6000 | |

MXN | Mexican Peso (USD/MXN) The Mexican peso remains influenced by US economic momentum and global risk appetite. While nearshoring trends support MXN structurally, geopolitical volatility can temporarily lift USD/MXN. If US data remains firm and oil volatility persists, the pair may test the upper range. Improved global risk tone could drive retracement toward 18.00. Bias: Volatile but supported by structural MXN strength. Mar 2026 USD/MXN Monthly Range: 18.00 – 19.20 | |

What Economic Data to Watch This Month

Mid-month inflation data and the Core PCE Price Index will be closely scrutinized for confirmation that price pressures are cooling in a sustained manner. Retail sales and GDP figures will provide insight into consumer demand and overall economic momentum, helping markets assess whether growth is slowing enough to justify a more accommodative policy path.

The release of FOMC Minutes will also be pivotal, particularly as markets evaluate the consistency of messaging amid recent shifts in Federal Reserve leadership dynamics. Any deviation from consensus expectations — whether in inflation, employment, or Fed communication — could trigger outsized FX reactions across USD-sensitive pairs, especially in an environment already heightened by geopolitical risk and oil-driven volatility.

| Currency | Date | Event |

|---|---|---|

| USD | Mar 3, 2026 | ADP Nonfarm Employment Change |

| USD | Mar 5, 2026 | Nonfarm Payrolls |

| USD | Mar 5, 2026 | Unemployment Rate |

| USD | Mar 10, 2026 | Inflation Rate |

| USD | Mar 12, 2026 | GDP |

| USD | Mar 12, 2026 | Core PCE Price Index |

| USD | Mar 17, 2026 | Federal Reserve Interest Rate Decision |

Currency market updates

Track key currency movements and plan your transfers with confidence.

Switch to MTFX for better exchange rates, lower fees, and real savings on foreign currency transfers.

We make sending money simple

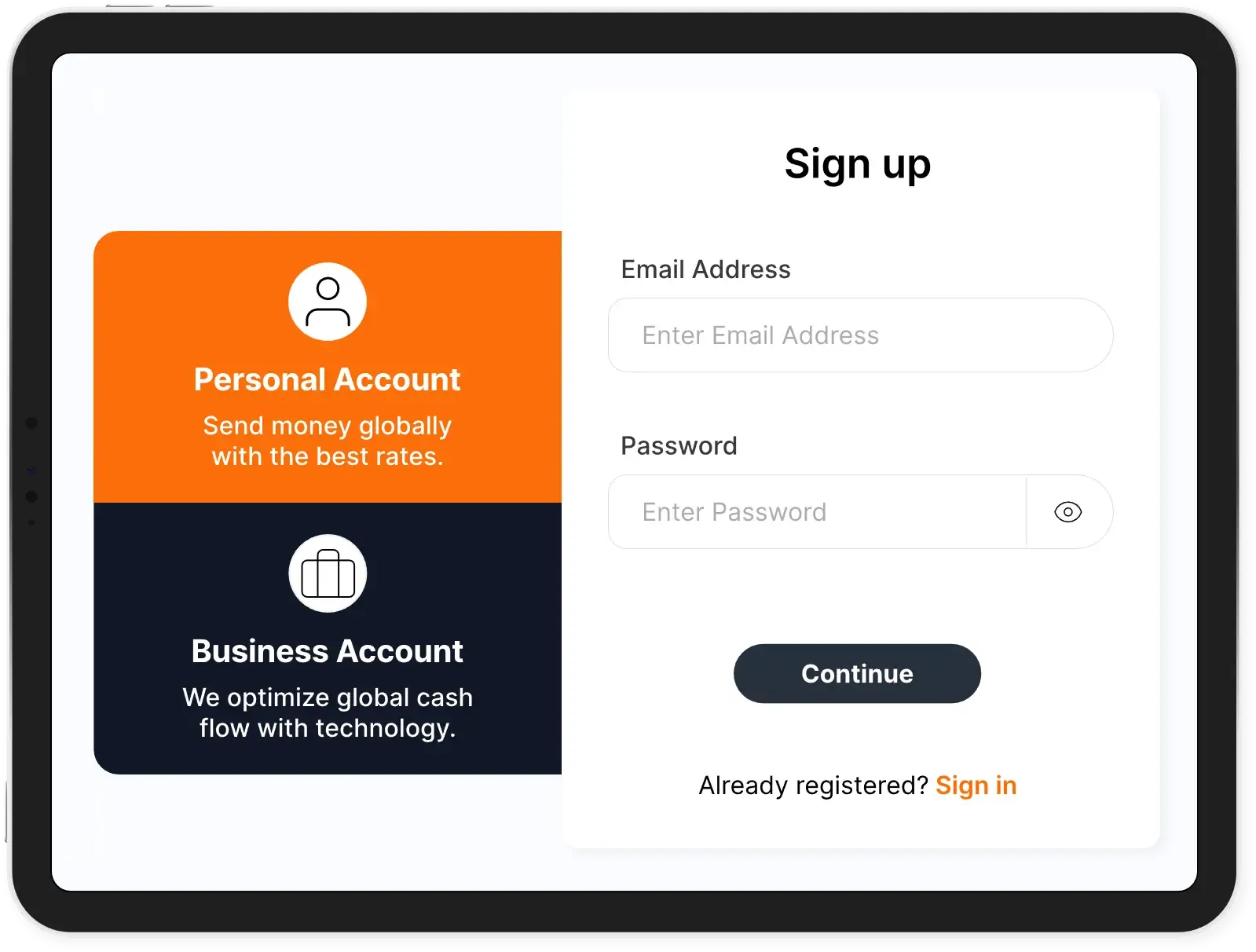

How to send money with MTFX

Open your personal or business account and start saving on international money transfers.

- 1Sign up for free

Create your account in less than five minutes—no setup fees or hidden charges.

- 2Get a real-time exchange rate

Instantly access competitive exchange rates for your transfer amount and destination.

- 3Enter recipient information

Provide your recipient’s banking details to ensure fast and secure delivery of funds.

- 4Confirm and send your transfer

Review the details, complete your transaction, and track your transfer every step of the way.

What drives monthly changes in the US dollar exchange rate?

The USD dollar exchange rates shift monthly based on economic data, monetary policy, and global events. While some changes are minor, others can significantly impact international payments and investments.

Key factors behind monthly USD moves:

What drives monthly changes in the US dollar exchange rate?

The USD dollar exchange rates shift monthly based on economic data, monetary policy, and global events. While some changes are minor, others can significantly impact international payments and investments.

Key factors behind monthly USD moves:

Federal Reserve policy

Rate hikes or dovish signals can strengthen or weaken the dollar.

Inflation reports

Data like CPI and PPI shape expectations for interest rate changes.

Employment figures

Nonfarm payrolls and jobless rates reflect overall economic health.

GDP growth

Strong or weak economic performance affects USD sentiment.

How much can the US dollar move in a month?

The US foreign exchange rates can fluctuate by 1% to 3% against major currencies in a typical month. However, during periods of high volatility—such as interest rate hikes or geopolitical shocks—monthly movements may exceed 5%, especially against currencies like the Japanese yen or emerging market pairs.

These shifts directly impact the cost of international transactions, from sending money abroad to paying overseas suppliers. Staying informed on the USD forecast and understanding what drives these changes helps individuals and businesses make smarter financial decisions and manage currency risk more effectively.

With MTFX, you can send money to over 190 countries in 50+ currencies—quickly, securely and at competitive rates.