Currency Views |

| USD |

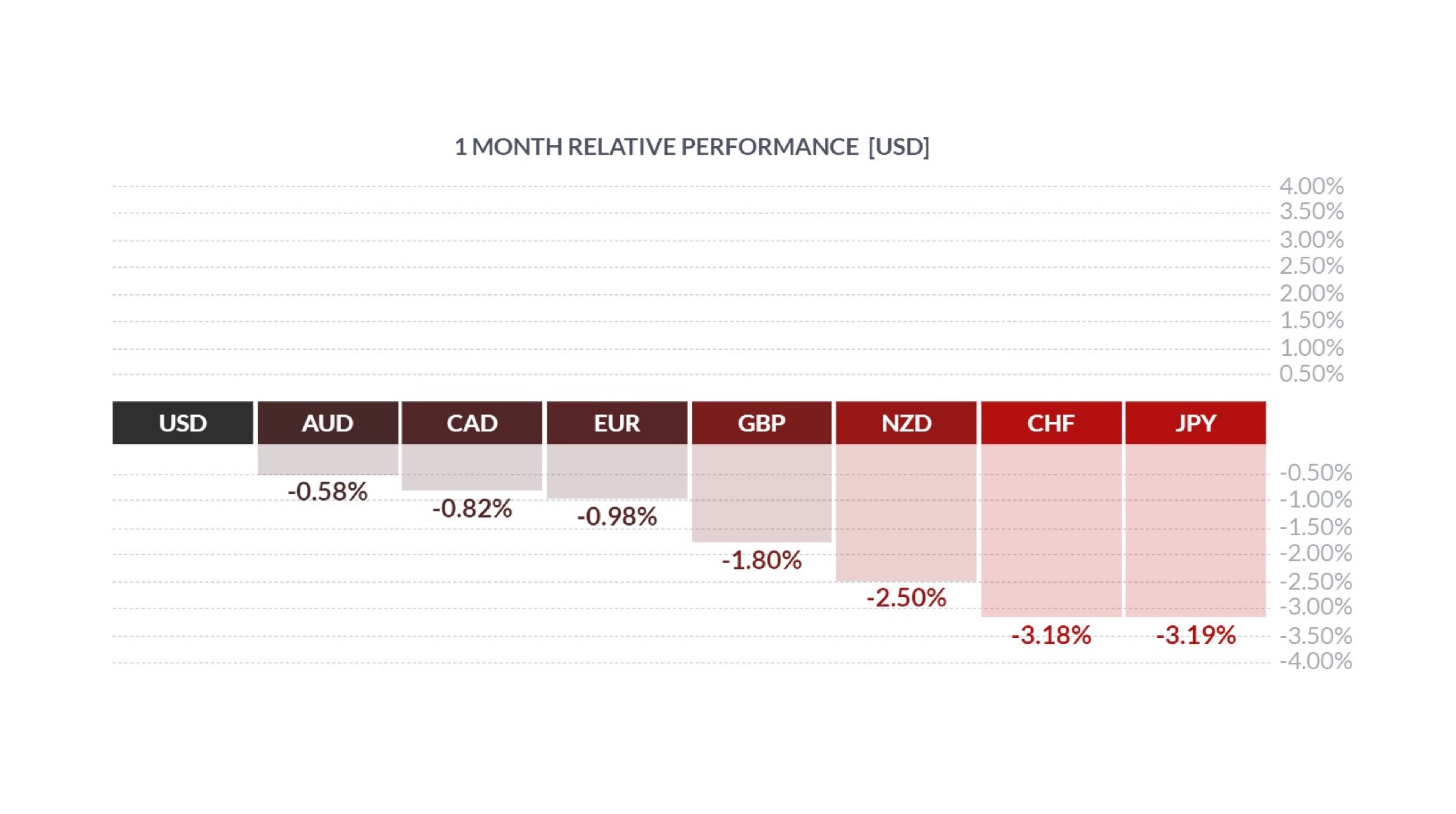

The USD kicked off the new trading month with a notable uptick as yields surged again. It's becoming increasingly evident that the US two-year note yield is the primary driver influencing the dollar's exchange rate. The March US employment data was stronger than expected and lends support to the re-acceleration the US economic activity. These data releases are poised to bolster the Federal Reserve's hawkish stance and fuel optimism among dollar bulls., The USD could still have room to appreciate against major currencies. Such a scenario might spell trouble for risk assets and other currencies.

|

| CAD |

There's little doubt that the Bank of Canada will maintain its current stance (no change since July 2023) when it convenes on April 10, keeping the overnight lending rate steady at 5.0%. Divergent employment reports released on April 5 pushed the Canadian dollar to its lowest point of the year, with the greenback nearing CAD1.3650, its strongest position since last November. Forecasts suggest the Canadian dollar will fluctuate within the range of USD/CAD1.3400-1.3800, as disparities in US-CAD interest yields are likely to counterbalance gains in commodity prices. Ultimately, the trajectory of the USD/CAD exchange rate will hinge on which central bank, the US Fed or the Bank of Canada, cuts interest rates first.

USD/CAD Forecast - Q2 2024: 1.35 | Q3 2024: 1.31 |

| EUR |

The disparity in data between the US and the eurozone has contributed to driving the euro to new lows in the first quarter of 2024. Despite unemployment in the eurozone staying at 6.4%, economic growth has been minimal, fluctuating around +/- 0.1% since the end of Q3. However, eurozone inflation has been stronger than expected. The European Central Bank, in its March monetary policy meeting, maintained a cautious approach but acknowledged the possibility of adjusting its stance by June based on recent data and forecasts. As a result, the EUR/USD exchange rate is expected to remain relatively stable due to uncertainty about short-term direction.

EUR/USD Forecast - Q2 2024: 1.09 | Q3 2024: 1.10

|

| GBP |

Sterling began March like a lion, roaring from $1.26 to almost $1.29, the strongest it had been since last July. However, as the US dollar regained strength and the Bank of England's hawkishness waned, sterling surrendered its gains, reaching a new low for the month at $1.2575 by late March, finishing the month like a lamb. The market expects a gradual strengthening of the pound as the UK begins to display signs of moderate improvement, propelled by a significant decrease in inflation that has stymied growth over nearly two years.

GBP/USD Forecast - Q2 2024: 1.26 | Q3 2024: 1.27 |

| JPY |

The Bank of Japan delivered its first rate hike in 17 years after much deliberation, yet it didn't provide significant support to the struggling yen, which proceeded to hit a marginal new 34-year low. Despite the BoJ's decision to adjust its policy stance, the yen continued to weaken. These actions were mostly in line with expectations, but Governor Ueda's failure to strongly hint at further rate hikes led to renewed selling of the yen. Investors interpreted this as a sign that the event risk had passed and that a significant policy divergence between Japan and the rest of the world would persist.

USD/JPY Forecast - Q2 2024: 146 | Q3 2024: 143 |

| CNY |

In Q1 2024, the yuan depreciated by approximately 1.7%. Despite efforts to defend CNY7.20, Beijing eventually yielded to the overwhelming strength of the dollar, allowing the greenback to surge to new highs for the year, nearly reaching CNY7.23. Market expectations are inclined towards a strengthening of the CNY against the dollar in the medium term. Encouraging signals emerged for China's economy from key economic indicators in January and February, suggesting a potential breach of the 7.00 mark for USD/CNY.

USD/CNY Forecast - Q2 2024: 7.18 | Q3 2024: 7.07 |

| INR |

The rupee experienced marginal appreciation from its all-time lows last month due to strong inflows into domestic markets. It remained within a tight range of 83.20-83.50 as year-end dollar demand from importers and higher crude oil prices restrained further strengthening. A constructive view on INR is maintained, but the forecast for strength has been adjusted due to the expectation of a slower path to USD weakness.

USD/INR Forecast - Q2 2024: 83.00 | Q3 2024: 82.50 |

| AUD |

At the close of March, the Australian dollar remained relatively unchanged, though it did experience modest strengthening. The Reserve Bank of Australia's (RBA) guidance on the policy outlook was somewhat offset by the policy guidance from the Federal Open Market Committee (FOMC). The RBA is expected to proceed cautiously. Signs of an uptick in China and global growth are likely to support a modest upward movement in AUD/USD.

AUD/USD Forecast - Q2 2024: 0.66 | Q3 2024: 0.67 |

| NZD |

The New Zealand dollar ranked as the fourth worst-performing G10 currency, with increasing concerns over the economic impacts of the Reserve Bank of New Zealand's (RBNZ) monetary stance. These worries were reinforced by Q4 GDP data confirming New Zealand's entry into recession. Looking ahead, the global economic backdrop, particularly in China and the US, will be critical. Any heightened fears of a notable slowdown in these economies could lead to further downside for NZD/USD, resulting in significant underperformance of the New Zealand dollar

NZD/USD Forecast - Q2 2024: 0.62 | Q3 2024: 0.63

|

| MXN | In Q1, the Mexican peso emerged as the strongest G20 currency, marking a 3% gain against the US dollar. Mexico's economy continues to benefit from foreign investments. However, as the US elections approach, the peso may face potential weakness as President Trump's rhetoric on immigration and trade policies intensifies.

USD/MXN Forecast - Q2 2024: 17.03 | Q3 2024: 17.38 |